Super-deduction tax relief scheme

The UK Government's new capital allowance deduction.

Government encourage UK businesses to invest in new machine and plant assets.

The government announced in the budget this April, a tax relief scheme to encourage UK companies to invest now in new machinery. This super deduction capital allowance will enable companies to cut their tax bill if they invest in qualifying plant and machinery assets.

From April this year until the end of March 2023, companies investing in new machinery capital will be able to claim the following:

- A 130% super deduction capital allowance on qualifying plant and machinery investments.

- A 50% first-year allowance of the cost of qualifying special rate plant and machinery.

- This will allow companies to cut their tax bill by up to £0.25 for every £1 they spend on new machinery.

- There is no limit to the investment organisations can spend to qualify for this super deduction.

- Assets can be funded via Hire Purchase finance, but excludes operating leases.

- Not available to unincorporated business such as sole traders and partnerships.

The government has announced this tax cut amongst others to support business and to restore the harm done to the UK’s economy. During the covid pandemic unsurprisingly business investments have fallen by 11.5% between Q3 2019 and Q3 2020.

This new policy is encouraging news, the government announced in the same budget many more incentives for companies, including business rates relief that will continue and keeping the furlough scheme in place until the end of September 21.

Time is of the essence, with the deadline next year, the government are incentivising firms to invest now in planned and additional investments, rather than waiting. This should help kick start the post-pandemic growth.

This information was gathered from the Government website. There are many more articles online going into finer detail, please see a couple below.

Recent articles

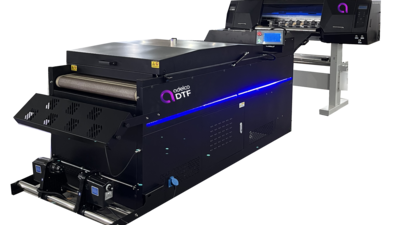

Why Precision Matters: The Role of Accurate Cutting in DTF Printing

Eco-Friendly Printing: How Integrated DTF Systems Reduce Waste